B€ing lit€rat€

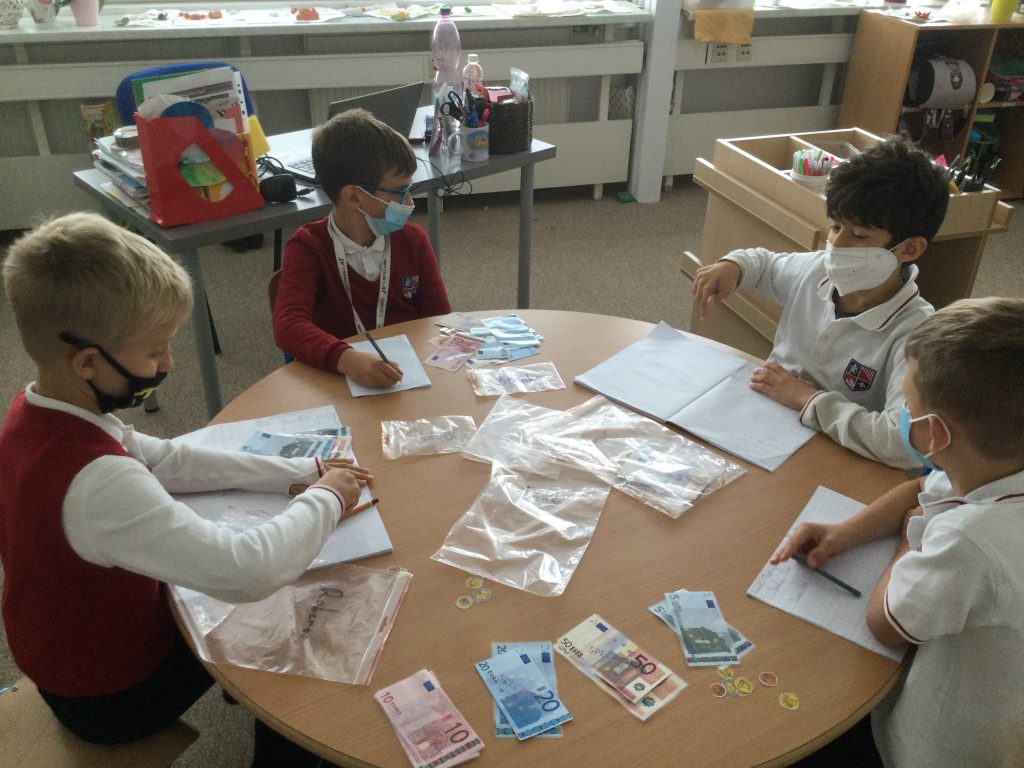

Financial literacy is a core life skill for participating in modern society. At some point children will need to take charge of their financial future. What better way to do that than with having some experience through role-playing situations where you can try out ideas and make mistakes without really being financially penalized. I learned at too old an age what interest rates, savings accounts and spending decisions could do for my financial future. As an educator, I hope that not only financial literacy, but financial role-play becomes a living part of school curriculum. In this way, students will be better equipped to make more effective and responsible choices in the complex reality of this century.

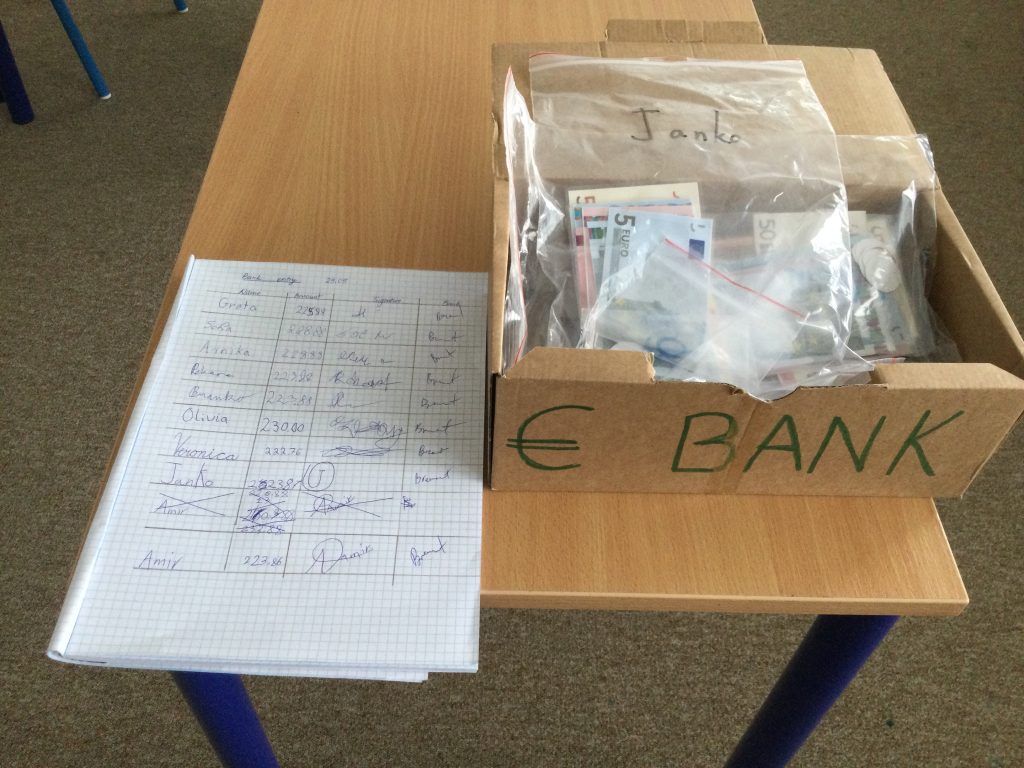

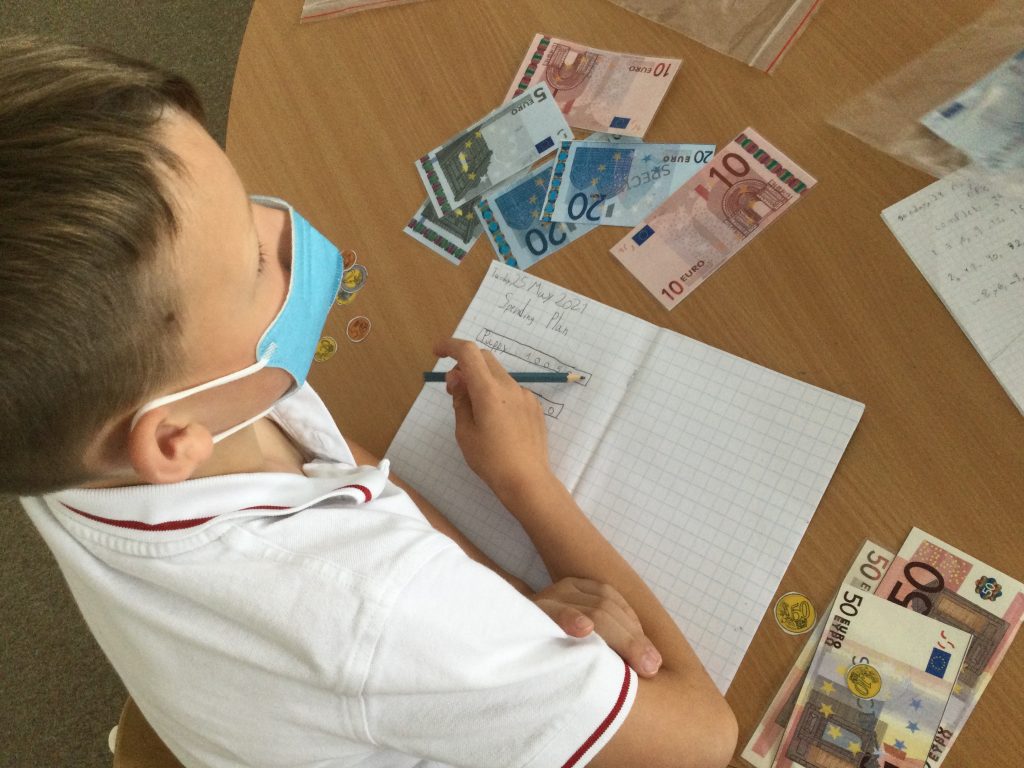

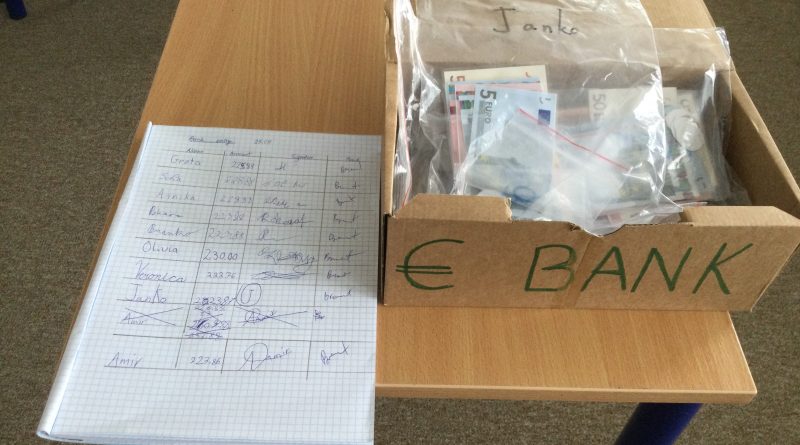

Year 3 took on financial literacy by preparing a spending plan and debating whether or not to place money into a bank account. With signatures and waiting in a line (our internet banking app is not yet available 🙂 ), each student opened an account and ‘deposited’ their money into the bank. During this unit, students will explore more real life financial premises using their role-play money.